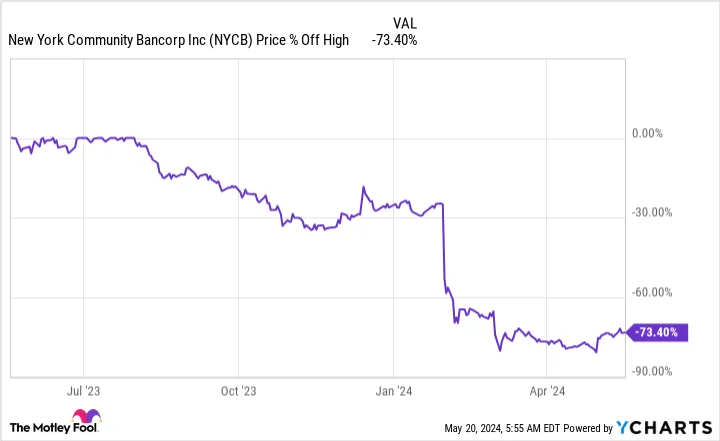

Is It Too Late to Buy New York Community Bancorp Stock? Expert Analysis and Market Insights

As investors evaluate their options in the ever-changing stock market, a common question arises: Is it too late to buy New York Community Bancorp (NYCB) stock? This article aims to provide expert analysis and market insights to help potential investors make informed decisions.

New York Community Bancorp, a well-established bank holding company, has garnered attention from investors due to its strong financial performance and consistent dividend payouts. However, determining whether it is the right time to invest in NYCB requires a closer look at various factors.

One key consideration is the current market trends. It is essential to assess the overall state of the stock market and the banking sector. As of May 28, 2024, the stock market continues to exhibit positive growth, with many investors finding opportunities for favorable returns. The banking sector, in particular, has seen steady growth, driven by factors such as economic recovery, low interest rates, and increased lending activity.

In the case of NYCB, experts suggest that the stock still holds potential for growth. Despite recent price appreciation, there are indications that NYCB stock may not have reached its full potential. Analysts point to several key factors supporting this perspective.

Firstly, NYCB maintains a strong financial position, with robust earnings and healthy balance sheets. The company has a long history of profitability and has consistently generated substantial revenues. This stability and financial strength bode well for the stock’s future prospects.

Secondly, NYCB’s dividend history is an attractive feature for income-oriented investors. The company has a solid track record of paying dividends, providing investors with a steady stream of income. With interest rates remaining low, NYCB’s dividend yield may be even more appealing compared to other investment options.

Furthermore, NYCB has been actively pursuing growth opportunities and expanding its market presence. The company has made strategic acquisitions, enhancing its capabilities and expanding its customer base. These initiatives position NYCB for potential future growth and increased shareholder value.

However, it is crucial to acknowledge the potential risks and challenges associated with investing in NYCB stock. The banking industry is subject to various external factors, including regulatory changes, economic fluctuations, and competitive pressures. Investors should carefully monitor these factors and conduct thorough research before making any investment decisions.

Additionally, the stock market is inherently unpredictable, and NYCB stock may experience short-term volatility. Market conditions and investor sentiment can influence stock prices, potentially leading to fluctuations in NYCB’s value.

In conclusion, the question “Is it too late to buy New York Community Bancorp stock?” requires careful consideration. Based on expert analysis and market insights, NYCB stock appears to have potential for growth, supported by its strong financial performance, consistent dividends, and strategic initiatives. However, investors should conduct thorough research, consider market trends, and assess their risk tolerance before making investment decisions. As always, seeking guidance from a financial advisor is recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are advised to conduct their own research and consult with a financial advisor before making any investment decisions.